07 Feb

Freemium No Longer: Understanding Eventbrite’s rationale in curbing free events

Eventbrite rocked the event creator community in 2023 when it announced a series of plan / pricing updates which included a major change that arguably eliminates its free offering for a large segment of creators. Starting in July, Eventbrite began charging organizers who are hosting free to attend to events with more than 25 invitees, ending its longstanding free tier that’s been in place since its founding back in 2006.

While this change was initially buried in a broader announcement in which the company disclosed a significant change to its fee structure (for paid or ticketed events), the implications of the decision to drastically curb (or arguably eliminate) its free offering could have broader implications as the company aims to better monetize its events marketplace.

Update: As of September 2024, it appears that Eventbrite has reversed course, announcing they would once again allow events of any size to publish without additional charge.

Why the change?

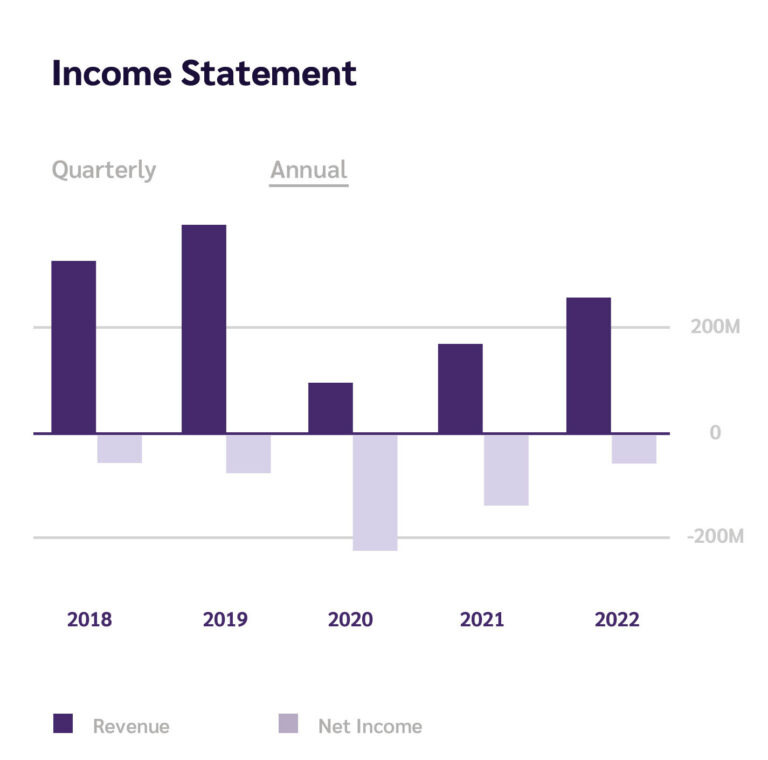

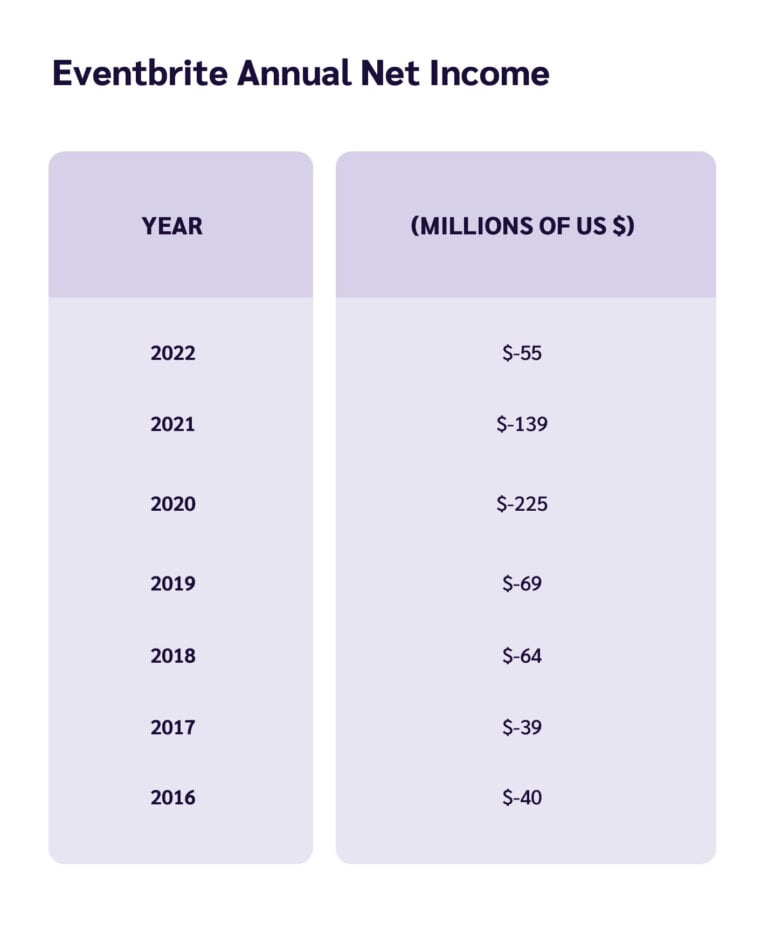

It’s evident that the rationale behind the company’s decision to increase pricing and begin charging for free events is revenue-related, so it’s worth taking a quick look at the company’s financial history. Like most tech darlings of the past two decades, Eventbrite has spent the vast majority of its history operating in a bull market fueled by low (near zero) interest rates. The abundance of cheap capital led Eventbrite (and many other tech companies – e.g. Uber, Airbnb, etc.) to pursue growth at all costs. This included growth that wasn’t profitable (and arguably would never become profitable).

While common knowledge in the investor community, many event professionals and longtime Eventbrite users might be surprised to know that despite its significant market share, strong brand awareness, and longevity in the space, Eventbrite has, intentionally or not, never achieved profitability.

The pandemic served as a pretty scary wakeup call for the company, as the industry saw its healthy stream of ticket sales get turned off virtually overnight. While we saw this sudden drop in ticket sales firsthand at RSVPify, our formerly healthy (but also suddenly churning!) SaaS business gave us a bit more breathing room than had we been dependent on a GMV model more akin to Eventbrite’s.

To their credit, Eventbrite leadership responded extremely quickly, shuttering unprofitable projects (including its entire music division), laying off nearly 50% of their headcount, and putting together a new strategic plan that helped the company secure a much-needed $100m round of financing necessary to weather what turned out to be a prolonged downturn for the events industry.

We’ll highlight a few ways in which Eventbrite’s new strategic plan has emerged since that pivotal period during the pandemic, but it’s fair to assume that the company’s decision to shift its focus to cultivating higher margin offerings is responsible for the recently announced rate hikes and changes to the historic free offering.

Eventbrite’s incredible (yet problematic) value proposition

If Eventbrite is going to capitalize on its market position and begin to focus on driving profitability, it’s helpful to better understand the company’s value proposition and how it’s arguably a poor fit for its existing (marketplace, purely GMV-centric) business model.

Eventbrite has long been the leader in helping event hosts market their events online. They were the first to empower the creator community with a simplified and streamlined means of processing event transactions (i.e., ticket sales) and quickly leveraged its rapid adoption and massive event/ticket volume to establish itself as a marketplace in which potential event goers could browse local events to attend. Event organizers (understandably) love this promotional / discovery element of the platform, as it offers them an inexpensive way of gaining exposure for their events in the relevant geographical markets.

In fact, Eventbrite is so effective at amplifying the visibility of its organizers’ events that it estimates that it generates 25%+ in incremental ticket sales for its event organizers. Put another way, Eventbrite creators are able to garner 25% more attendees via the platform than through attempting to independently manage and market their events.

Given this objectively strong value proposition, it’s fair to ask why the company doesn’t just increase visibility (e.g., invest in sales attribution tools) into those incremental ticket sales and drastically increase the fees on those transactions. Surely organizers would be willing to accept giving up a larger share of the pie for the incremental ticket sales that could be verifiably attributed to Eventbrite’s marketplace and marketing offerings, right?

Well, even if we were to assume that was to be the case (which admittedly might be a stretch – attribution is tough!), the company has a much bigger obstacle. According to its own reports, as much as 70% of the ticketing volume processed on its platform is for free (to attend) events. So while the company does do a fantastic job of generating interest and demand for these events, so much of that value is for a free segment that cannot be captured by increasing (e.g. tripling) its take rate. As the adage goes “3 times zero is…well, zero”.

Facing increasing pressure from investors to demonstrate a path to meaningful profitability, Eventbrite refined its focus and decided to concentrate on providing the most amount of unique value (i.e. driving incremental sales) to its most importantuser persona (professional and repeat event creators).

The right data at the right time

A byproduct of having spent nearly two decades operating the leading events marketplace, Eventbrite’s most valuable asset is the enormous trove of first-party data reflecting user habits around event attendance. While more and more people over the years turned (and returned) directly to the company’s marketplace to purchase tickets for events meeting their unique interest(s) and geographies, Eventbrite has been accumulating incredible amounts of user preference and purchasing data. While this data has always been of value for the company and its creators, it became absolutely paramount in the wake of Apple’s iOS 14 privacy update, as creators suddenly found that they were no longer able to profitably drive ticket sales via traditional online advertising channels such as Instagram and Facebook.

It is on the basis of this data that the company decided to build a subscription business to event creators who found themselves suddenly desperate for alternative advertising channels.

How did it build this business? Introducing Eventbrite Boost

To accelerate the speed with which it could bring this offering to market, Eventbrite acquired Toneden in November 2020, an ad-tech company that specializes in helping users optimize its Facebook ads to drive conversion. It then worked to integrate the two offerings, putting Toneden’s engine atop its massive proprietary dataset and launched an in-house marketing suite that the company rebranded to “Eventbrite Boost”.

Rolled out publicly to users in May 2021, Boost offers a suite of features packaged together for Eventbrite users to amplify events to wider audiences. Here are a few elements of Boost as described by Eventbrite’s media team:

- “Creators can publish their events to Facebook using a special integration we have called Add to Facebook. This integration lets attendees buy tickets without leaving the Facebook App.”

- “And if you want to save time and make better, more targeted Facebook & Instagram Ads… creators can do that with our version of Facebook Ads Manager, built specifically for event creators. In other words, creators can now build Facebook Ads without leaving Eventbrite.com.”

- “Bundled the advertising offering with an in-house email marketing platform that allows creators to send emails to your past attendees and email subscribers. Similar to how they would with Mailchimp.”

By packaging together email and social promotional tools for increased fees from event creators, and the ability to demonstrate that Eventbrite believes it can generate up to a 25% increase in total ticket sales from previous performance, Boost provides the company with what it has long needed – a meaningful / differentiated (and high margin!) subscription offering that allows it to monetize the unique value it generates for its top creators.

So what comes next for Eventbrite?

Eventbrite has clearly bet big on its fundamental shift to focus on creating and growing a number of high-margin marketing and subscription-based services for its top creators and from where we are sitting, rightfully so. It’s a savvy move to address public market investors’ sudden emphasis on profitability, and one that would be quite hard for competitors to emulate.

That said, we have to wonder if the company’s current and future data-driven business lines are largely being powered by the volume of data inherent in its free segment. Could it have made this move without trying to directly monetize its free tier?

Perhaps the timeline for these nascent revenue streams to achieve meaningful results is longer than the company scale, or the revenue needs are more urgent than it appears. Additionally, the impact on Eventbrite’s data value due to lower user volume will undoubtedly also be delayed.

Regardless, there is no shortage of legacy and emerging free alternatives in the event registration space waiting in the wings to present themselves as viable alternatives for creators formerly drawn to Eventbrite. It’ll certainly be interesting to see to what extent Eventbrite’s stranglehold on these high-frequency, low-complexity events is impacted over the coming months and years.

Travis Granger has served as Chief Operating Officer at RSVPify since 2019, after joining the company as VP of Product. A graduate of Northwestern’s Kellogg School of Management, he has worked at a variety of early stage startups and is passionate about helping organizations and people fulfill their potential. He also serves as the interim CEO of ChangeTower and currently lives in Austin with his wife and son.

Adam Hausman co-founded RSVPify in 2013 and has been passionate about event tech and ticketing software ever since. Also founder of Greenlight Growth Marketing, he holds degrees from Indiana University (BA English/Psychology 2008) and the University of Illinois-Chicago (M.Ed. Secondary Education 2012). He lives in Maine with his wife, 2 kids, and 2 annoying cats.

Adam Hausman